The Families First Coronavirus Response Act (H.R. 6201), requires new paid and unpaid leaves in response to the Coronavirus COVID-19 pandemic.

The Families First Coronavirus Response Act (H.R. 6201), requires new paid and unpaid leaves in response to the Coronavirus COVID-19 pandemic.

On Thursday, April 30th, 2020 the Governor Wanda Vázquez announced that she would extend the lock down and curfew orders with certain modifications providing for new exceptions to certain services, businesses and industries set to reopen, provided they met special safety and health standards, requiring Contagion Risk Management Plans, and allowing people to exercise. The Department of State published the new Executive Order No. 2020-038 on Friday, May 1st, 2020 at about 6:10 p.m.

On April 9, 2020, Puerto Rico enacted into law Act No. 37-2020, in response to the COVID-19 pandemic, to establish a special paid sick leave for non-exempt employees infected (or are suspected of being infected) due to a state of emergency declared by either the Governor of Puerto Rico or the Secretary of the Puerto Rico Health Department.

On July 1, 2023, the minimum wage of all non-exempt employees in Puerto Rico, as defined by Puerto Rico Act No. 47-2021 and who are covered by the Fair Labor Standards Act, will increase from $8.50 per hour to $9.50 per hour. Background of the Puerto Rico Minimum Wage On September 21, 2021, the Puerto… Read more »

On June 21, 2023, the Governor of Puerto Rico, Hon. Pedro Pierluisi Urrutia together with the Administrator of the State Insurance Fund Corporation, Jesús M. Rodríguez Rosa, announced dramatic measures and proposals for the next legislative session. The Governor announced a historic 50% reduction in workers’ compensation premiums for most employers, effective July 1st, 2023, as well as a legislative bill to increase weekly allowances by 100% and make cost-of-living adjustments for injured workers.

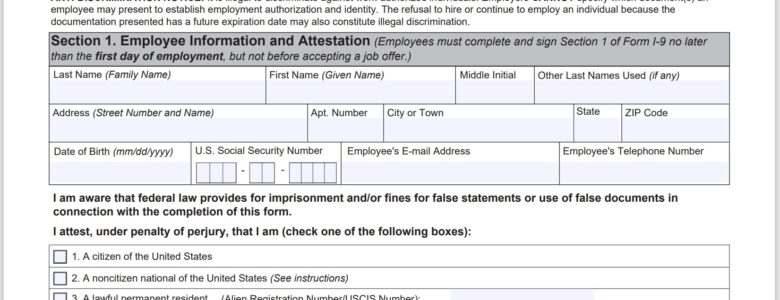

On Aug. 1, 2023, the U.S. Citizenship and Immigration Services published a revised version of Form I-9, Employment Eligibility Verification. Among the changes to the form is the addition of a checkbox that E-Verify-enrolled employers can use to indicate that they remotely examined identity and employment authorization documents using a DHS-approved alternative procedure. … Read more »

A new Puerto Rico law gives employees the right to request modifications and a reduced work schedule if they register as Informal Caregivers.

The workers’ compensation yearly experience review was changed on August 8th, 2023, by Act No. 85-2023, effective immediately, to offer an additional one-time fixed 5% special discount on premiums for establishments without occupational accidents for two years in a row. Experience-based discounts have historically been set by the Corporación del Fondo del Seguro del Estado in accordance with regulations and not specific legislative mandates.

The DOL proposes to raise the minimum salary and compensation for exempt employees under the FLSA. Learn how this affects employers in Puerto Rico and other U.S. territories.

The proposed rulemaking to revise 29 CFR Part 541’s interpretation of the salary thresholds applicable to the Fair Labor Standards Act’s exemptions from the minimum wage and overtime pay requirements for executive, administrative, and professional employees was published in the Federal Register on September 8th, 2023.

Sign up today to receive FREE legal information on NPC Attorneys at Law!